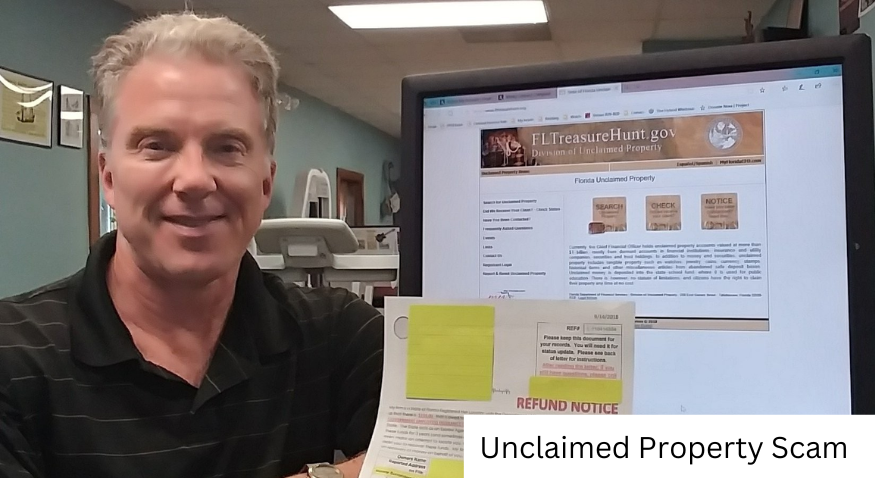

You may have received a letter or text message advising that you are entitled to unclaimed property. This is a scam. An unknown sender offers large amounts of cash and asks for your Social Security Number or your Venmo password. This is a common scam. It would help if you were suspicious of any requests for financial or personal information. Unclaimed property scams are real, even though it is possible to claim unclaimed property. They’re becoming more common.

Kathleen Lobell, director of the Louisiana Department of the Treasury’s unclaimed property division and senior vice president of the National Association of Unclaimed Money Administrators, says, “With the increase in identity theft problems in the nation, we are more aware of the risk than ever before.” “We are working to make sure that our tools for monitoring and catching these bad actors remain up-to-date.”

Lobell states that anyone could fall for a scam like this. However, the elderly are more likely to be targeted as a target because of their age.

Instead of relying on fraudsters to connect you with unclaimed assets, search official websites to find them. Here are the facts.

What is an Unclaimed Property Scam, and How Can I Avoid It?

Unclaimed property refers to money and assets not claimed by the owner. The state will eventually hand over the money if it isn’t possible to find you. This includes money you forgot to cash, the money you overpaid for utilities, or money you left behind as a security deposit. The state holds it until you claim it.

Scammers who claim to be claiming unclaimed property can take advantage of this opportunity to steal your assets or identity. A scammer will usually try to convince you to give your information by pretending that they are a government official. They might promise to reunite you with a large amount of money or another asset, such as a vehicle. They are only trying to make a profit from you.

How to avoid scams and claim your property or money safely

To avoid being scammed about unclaimed property, you should be proactive. Don’t respond to messages that instill fear and urgency with warnings like “time is running short; act immediately.”

Lobell states that it is always better to search for the contact information of the agency yourself than to respond to messages. You can verify that you are dealing with an open source by looking for the.gov domain or using a trusted source.

If a source claiming that they are from your state government contacts them via text, this can help you quickly identify unclaimed property scams. Lobell states that “a state will never contact me by text.”

A search for unclaimed property is easy and free. For more information on searching for unclaimed property in your state, visit the National Association of Unclaimed Property Administrators website. MissingMoney.com can also be used to conduct a nationwide search and then direct you to file a claim at the appropriate state site if you find any unclaimed property.

Avoid third-party services

These are not scams. However, unclaimed property locators (also known as “finders”) charge a fee to locate unclaimed property. This is something you can do free of cost.

Although finders usually act legally and are regulated in certain states, they don’t have to be licensed. It can be difficult to distinguish a good from a poor finder.

Lobell states, “Remember that state unclaimed properties offices don’t charge anything for searches and to facilitate claims.” “If you are asked for money, it is not a legitimate site of the state.”

The bottom line

Scams involving unclaimed property are becoming more common. You can verify a notice you received from someone asking about money. This will ensure that you don’t lose any cash or expose your identity when you try to claim the property.

Experian CreditWorks(sm), Premium is a service that can monitor your credit reports from all three credit bureaus (Experian TransUnion and Equifax) for identity fraud, provide identity theft insurance, and connect you with personal fraud resolution agent support whenever it’s needed.

A fraud alert can be requested on your credit reports to ask potential creditors for verification of your identity. This will help you mitigate any harm. If your identity has been compromised, you can file a report at the Federal Trade Committee or with law enforcement.

Also Read: